- #Capital one walmart credit card full#

- #Capital one walmart credit card professional#

- #Capital one walmart credit card free#

#Capital one walmart credit card full#

For a full comparison of Standard and Premium Digital, click here.Ĭhange the plan you will roll onto at any time during your trial by visiting the “Settings & Account” section. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. Standard Digital includes access to a wealth of global news, analysis and expert opinion.

#Capital one walmart credit card professional#

And if you need professional help to boost your credit score, consider reaching out to a reputable credit repair company like Credit Saint.During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. By understanding the factors that affect your approval odds and taking steps to improve your credit, you can increase your chances of getting approved for this valuable rewards card. Obtaining a Walmart Rewards card requires a solid credit score, stable income, and responsible credit management.

#Capital one walmart credit card free#

If you’re looking to increase your chances of getting approved for new credit, visit their website and fill out the form for a free credit consultation. They help clients remove inaccurate negative items from their credit reports, including: If you’re struggling with a low credit score and need help improving it, consider seeking assistance from a reputable credit repair company like Credit Saint. Seeking Professional Help to Boost Your Credit Score

Debt-to-income ratio: Your debt-to-income ratio is the percentage of your income that goes towards paying off your debts.Income: Credit card issuers want to ensure that you have a steady income and can comfortably afford to make payments on your card.Factors That Affect Your Approval OddsĪpart from your credit score, there are other factors that can influence your approval for the Walmart Rewards card:

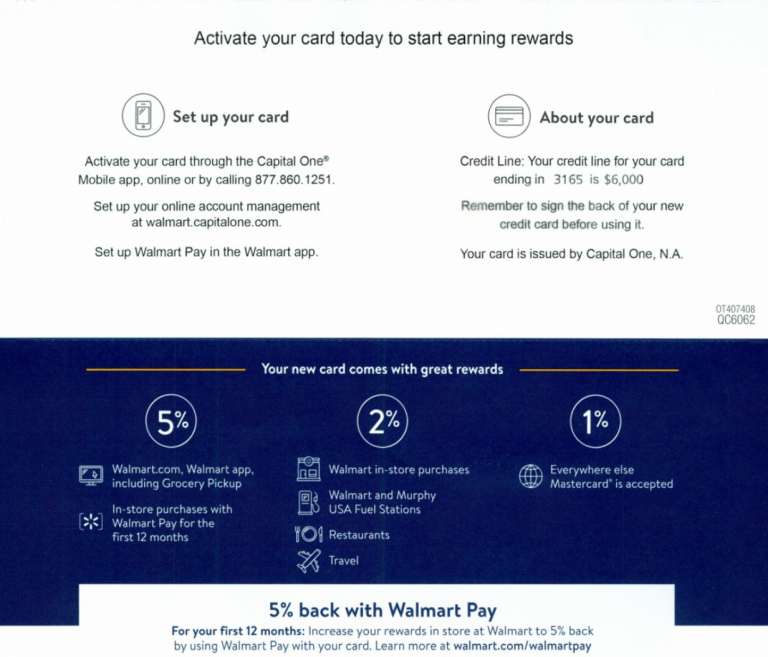

However, credit score alone won’t guarantee your approval, as Capital One also considers your income, debt, and any negative items on your credit report. While a credit score of 700 is recommended, some applicants have been approved with scores as low as 640. When you’re considering applying for a Walmart Rewards card from Capital One, it’s crucial to understand the credit score and other factors that will impact your chances of approval.

0 kommentar(er)

0 kommentar(er)